Advisor Solutions

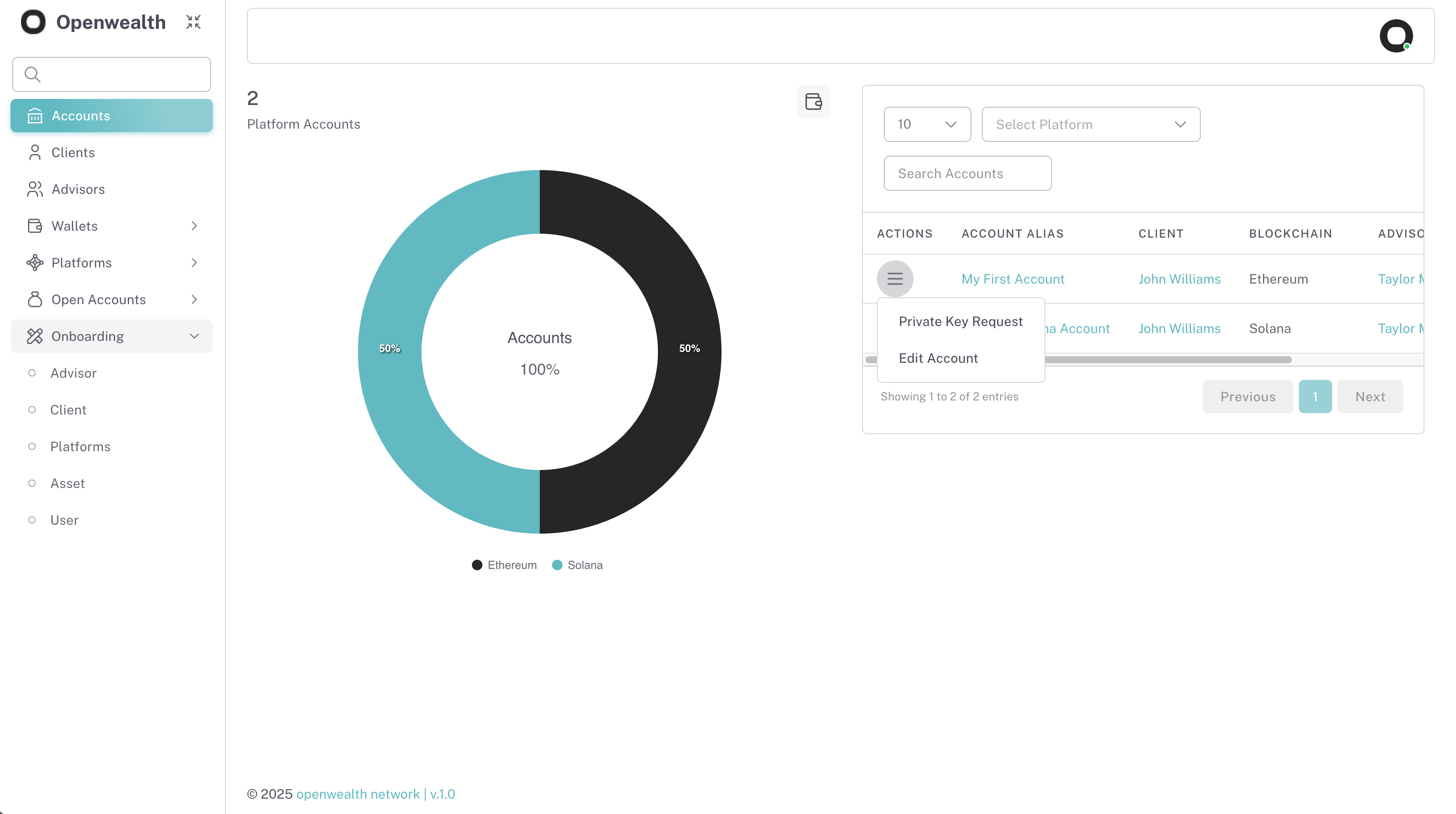

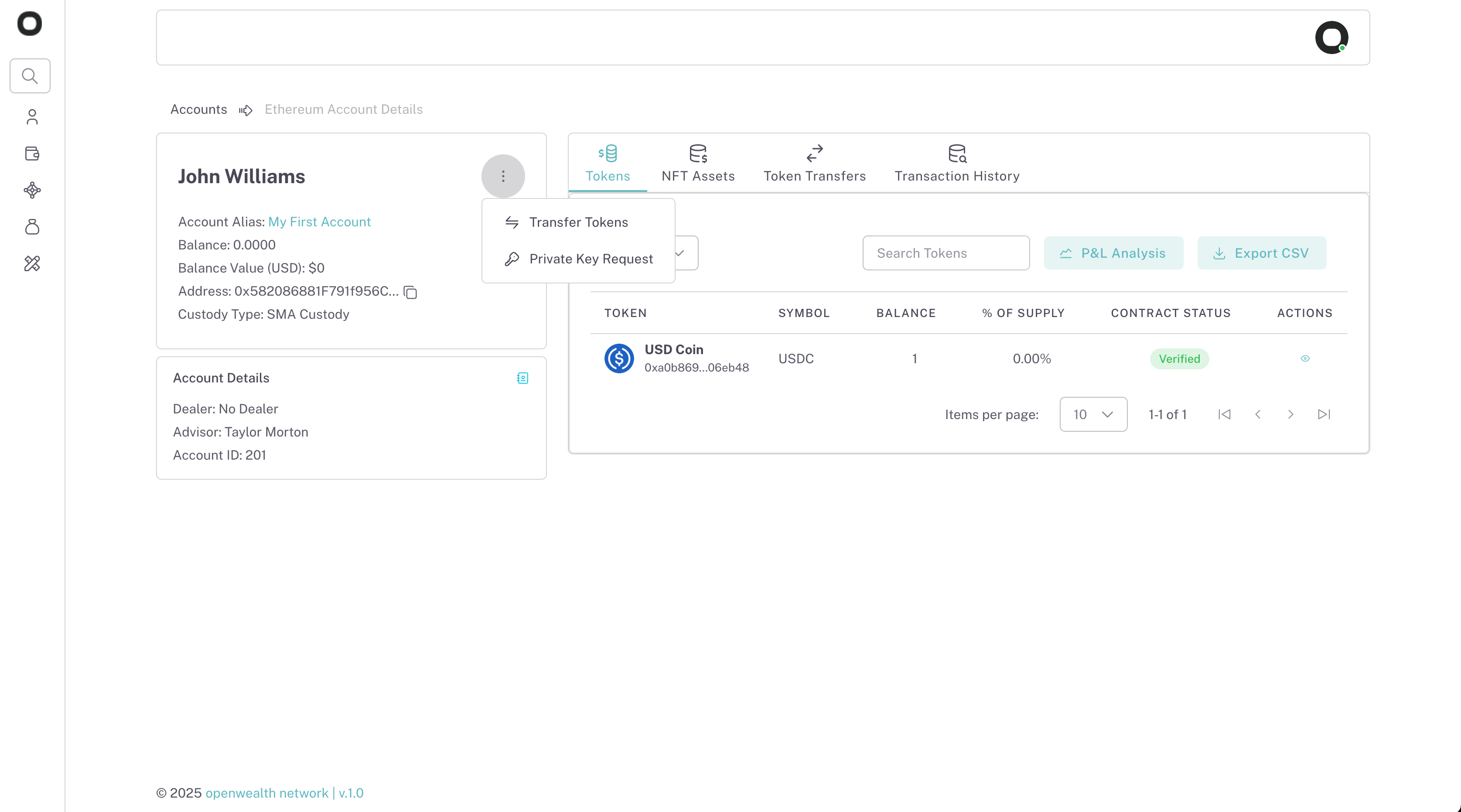

Held Away Asset Reporting

A platform of applications to view or manage client wallet accounts, track crypto holdings and report on client portfolios alongside traditional investments. Estate planners and executors can use our platform to seamlessly inventory accounts across exchanges, custodians and self-custody wallet providers.

Portfolio Management

We empower advisors with tools to do independent research of Crypto & DeFi platforms and discretionary trading integrations to manage client portfolios under regulated investment frameworks.

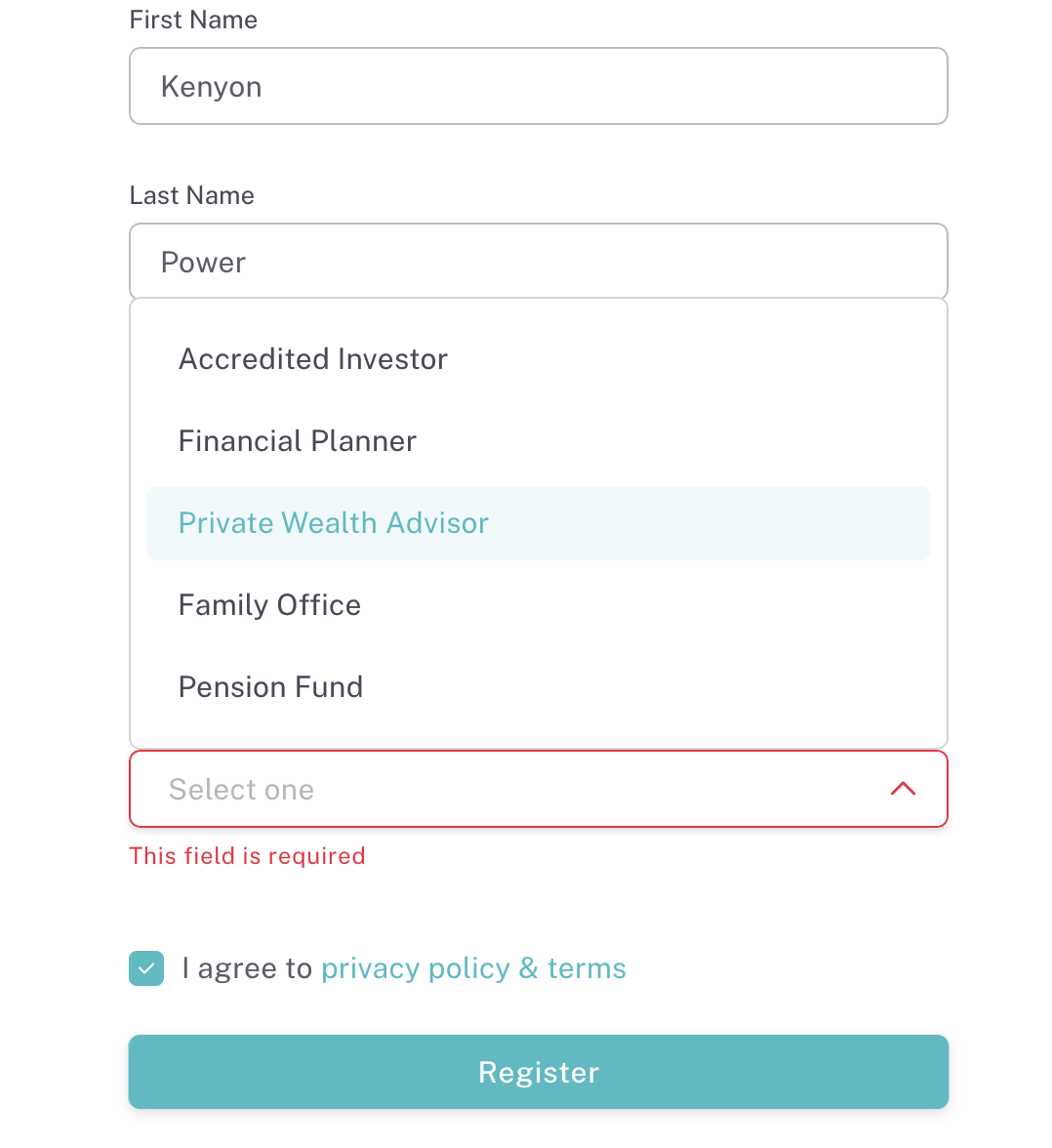

Dealer Solutions

Client & Advisor Portals

Seamlessly connect portfolios, track performance, and fund accounts in crypto or fiat—fully integrated with your investment systems for effortless oversight and reporting.

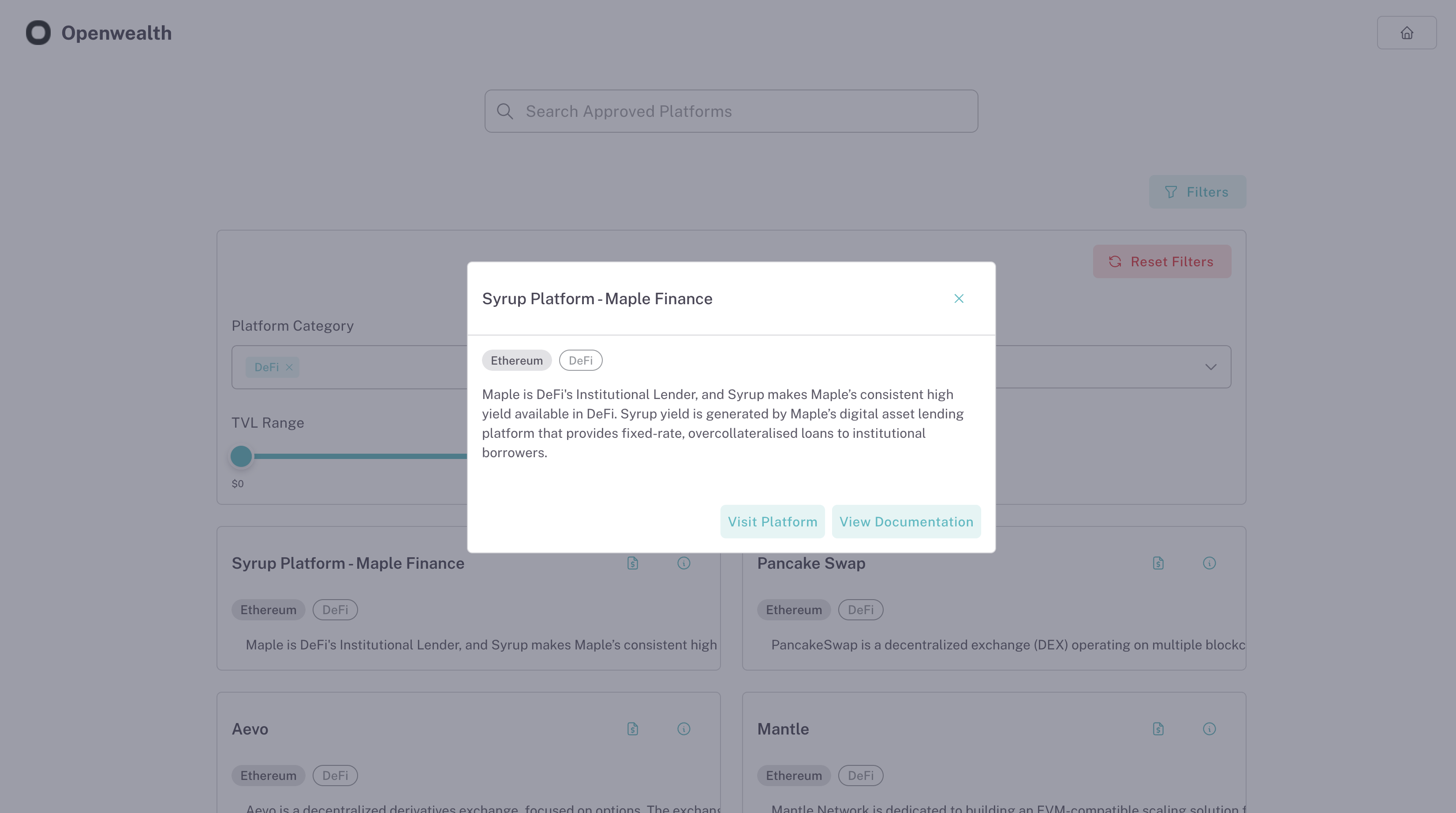

Crypto & DeFi Product Shelf

An out of the box solution to onboard and integrate tokenized products to investment platforms. Advisors and wealth clients can research assets and DeFi platforms, review head office due diligence with access to our embedded AI research advisor to compliantly navigate the complex world of tokenized assets as a fiduciary.

Lending Solutions

Crypto Loan Origination

Onboard crypto borrowers with our pre-built workflows, including borrower verification, proof of funds verification, asset transfer interfaces, escrow account provisioning, loan approval interfaces, real-time LTV calculator and integrations with custodians and pricing oracles.

Borrower & Lender Portals

Streamline crypto loan operations with an enterprise-grade wallet infrastructure. We offer turnkey solutions for automated collateral tracking, programmable enforcement of lending terms, a whitelabel borrower portal and liquidiation services through DeFi platforms.

Asset Management Solutions

Capital Flow

We provide a turnkey solution that enables asset managers to grow fund AUM from crypto investors.

Account Recordkeeping

A full service platform for onboarding stablecoins as a method of payment for funds. We provide integration support with transfer agent systems for ongoing recordkeeping, embedded KYC/AML interfaces to accept crypto assets and audit-ready reporting to meet regulatory requirements.